Over the weekend news broke that First Republic Bank (FRC) was taken into receivership by the FDIC. This basically means they went bust and the government stepped in to steward client accounts until a deal could be struck with another bank to buyout the viable parts of the business.

This morning we learned that JP Morgan (JPM) won the bid and the country’s largest bank just got even bigger. The tally of bank failures in the last two months now includes:

Silicon Valley Bank (SIVBQ)

Signature Bank (SBNY)

Credit Suisse (CS)

Silvergate Bank (SI)

First Republic Bank (FRC)

I describe the underlying cause of the failures in detail here, but today I want to opine on the outlook for the future.

Because interest rates were near 0% for ~13 years, the loans banks made during that time have very low interest rates. Think of this as the banks’ income. Over that same period, banks were able to get away with paying customers near 0% for deposits. Think of that as the banks’ cost. Until now the business was okay because interest rates on everything was low. However, with rates now much higher, someone with extra cash can buy a money market mutual fund like the Vanguard Treasury Money Market Fund that is practically risk free and earn 4.65% at the time of writing.

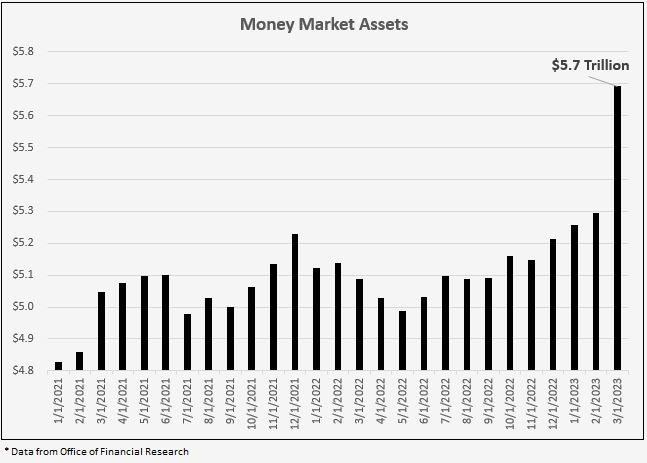

Naturally, people don’t want to earn 0% - 1% on their cash if they can earn 4.5% - 5%, especially when they are fearful that their bank may collapse. So, as a result depositors have been pulling money from their banks and putting them into money market funds at an astounding rate.

Why don’t banks just offer a competitive rate on deposits?

Good question. They can’t. Remember, their loans (i.e. their income) is mostly locked in at super-low rates. 30-year fixed rate mortgages were available for 2.5% not long ago. New car loans were priced at 1.99% for 84 months. If banks offer you 4.5% on your deposits they’ll be losing money, and losing it fast.

So the stage is set. There’s no reason for people to keep excess cash at their bank when they can earn 3-4x in a risk-free money market fund, but banks can’t match those rates because it’ll put them under. If you’re thinking “Catch 22” then you’d be correct.

How will this play out?

The only viable solution is that the Fed will need to loosen monetary policy. This could mean providing liquidity (money printing), lowering interest rates, or both. In fact, the market is betting on it according to the Atlanta Fed and so is billionaire investor Stanley Druckenmiller, who recently announced he’s betting against the US Dollar, a move that will profit if the Fed lowers rates or prints more money.

What can average folks do?

If you have less than $250,000 in deposits then your cash is covered by FDIC insurance in the event your bank goes under. But, even if you’re below that threshold there’s a strong case to take advantage of the higher interest rates being offered by money market funds compared to bank deposits. Money market funds are covered up to $500,000 by SIPC insurance.

The brass tacks is that the path of least resistance is for monetary policy to loosen. If the Fed remains stubborn, they risk setting off a cascading banking crisis. First Republic was the 5th major bank to fall, but others are certainly suffering from under water loans and bleeding deposits. Let’s hope the Fed reads the market signals and acts with prudence in the days ahead.

Thanks for giving me your time today. If you enjoyed the content, please consider subscribing or sharing with a friend who might enjoy it as well.

"Money is a good servant, but a bad master." - Francis Bacon

Great read!